In the latest episode of the Best Metrics Podcast, host Glenn Dunlap sat down with Leslie Boyd, Managing Principal of CLA's Manufacturing Practice, to explore the essential metrics CPAs should focus on when advising manufacturing clients. Here are some of the key insights for CPAs advising clients in the manufacturing industry...

EBITDA

When looking at a new set of financials for a manufacturing company, we first turn our attention to EBITDA, or Earnings Before Interest, Taxes, Depreciation and Amortization, a cornerstone metric illuminating a company's financial health. EBITDA's multifaceted role as a predictor of profitability and cash flow viability. EBITDA has implications across debt servicing, capital expenditure planning, and business valuation, and understanding it offers CPAs a nuanced perspectives to guide their manufacturing clients towards financial resilience and growth.

“I think sometimes people sit there and say. “Leslie, is it selfish to sit here and think about profitability?” I’m here to tell you that running a profitable and well run business is not selfish at all, that is a really important endeavor because profitability is really important to being able to make choices, to be able to invest…”

- Leslie Boyd, CLA

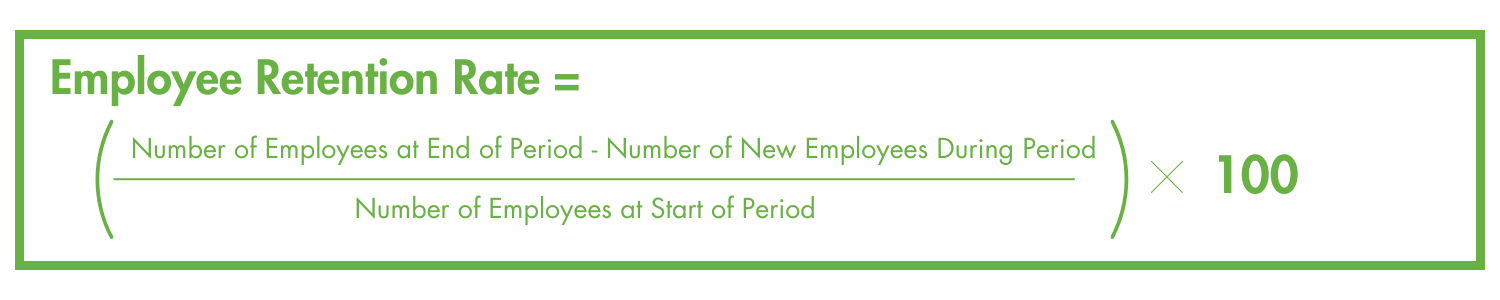

Employee Retention

The next metric to look at for this industry is employee retention which emerges as a pivotal metric, reflecting the vitality of a manufacturing business's workforce. There are many studies that tell you that engaging the numbers in the workforce has a direct correlation to profitability. Although it is less common to provide a CPA with this type of metric, as a CPA it is worth asking these questions because tracking turnover rates indicates the organizational health and productivity of a company, as opposed to just looking at the P&L statement. By understanding the correlation between employee engagement and profitability, CPAs gain invaluable perspectives to advise clients on fostering a culture of retention and empowerment, thereby driving sustainable growth and operational excellence, without interruptions like the cost of turnover and suffering scrap rates.

Inventory Turnover

.png?width=1500&height=300&name=Financial%20formulas2%20(1).png)

In a landscape rife with supply chain disruptions, inventory turnover emerges as a critical metric for manufacturing businesses. Managing inventory levels amidst fluctuating demand patterns is a complex endeavor. We recommend focusing on proactive inventory management strategies and leverage forecasting data to optimize turnover rates. This equips you with the insights needed to mitigate risks and seize growth opportunities for their clients.

Capacity & Value Added Revenue

Capacity utilization and value-added revenue drive profitability within the manufacturing realm. With the misconceptions surrounding fixed costs, it is worth delving instead into the intricacies of assessing capacity utilization rates with accuracy. The down side of using burden rates is that it assumes manufacturing companies are operating at 100% capacity. We recommend exploring strategies for optimizing available capacity and maximizing value-added revenue. This empowers CPAs to unlock revenue streams that were previously hidden and enhance operational efficiency for their manufacturing clients.

As manufacturing businesses navigate turbulent waters, CPAs emerge as trusted allies, armed with insights and strategies to steer their clients towards financial prosperity. This guide equips CPAs with the roadmap needed to navigate the intricacies of manufacturing metrics, empowering them to serve as strategic partners in their clients' journey towards sustainable success. With a focus on data-driven decision-making and continuous optimization, CPAs stand poised to guide their manufacturing clients towards profitability, resilience, and enduring growth in a dynamic and competitive landscape.

Listen to the full episode of the Best Metrics Podcast and dive even deeper into these topics here!

The Best Metrics Podcast is sponsored by Peerview Data, a benchmarking and comparative analytics software that automates and maps the raw data needed for CPA's to compare their clients in a specific industry against their peers throughout an industry segment. Peerview provides actionable insights for CPAs to begin consulting with their clients on complex issues, helping them to laser focus their resources, and ultimately driving revenue for both your clients and your firm.