Navigating the property management and development industry requires a keen understanding of various financial metrics and strategic planning tools. From analyzing Profit and Loss (P&L) statements to scrutinizing balance sheets for red flags, CPAs play an essential role in guiding clients toward financial stability and growth. This blog post delves into key areas that CPAs should focus on when advising clients in this sector, including P&L analysis, budgeting, key performance indicators like occupancy rates, and critical balance sheet metrics.

P&L

The Profit and Loss (P&L) Sheet is crucial in the property management and development sector. Obtaining a trailing 12-month P&L allows for a comprehensive month-over-month comparison, revealing important trends and seasonal fluctuations in utilities, repairs, and maintenance. Recognizing these patterns helps clients plan accurately for seasonal cost variations, ensuring better financial stability and budgeting.

For larger developers, key expense areas such as insurance, property taxes, and payroll dominate the P&L sheet. Insurance and property taxes have surged in recent years, impacting profitability. Close monitoring and strategic management of these costs are essential. By focusing on these areas, CPAs can offer valuable insights and strategic guidance to their clients.

Budgeting

It's important to address the budget that the client has in place. Ensure they account for higher interest rates, increased construction costs, and savings for capital improvements such as remodels and appliance updates. Clients should also budget for smaller expenses from tenant move-outs, including cleaning and minor repairs.

Planning for these routine expenditures depends on the type of property, whether it's brand new or older. Clients often specialize in one type of property or the other. New units typically require minor clean-up, while older properties necessitate saving for major remodels and potentially more costly repairs. Properly anticipating and budgeting for these expenses is essential for maintaining the property's value and functionality.

Budget accuracy is inherently uncertain; it will likely deviate from actual results, either exceeding or falling short of goals. Treat the budget as a guide and avoid frequent changes to maintain a clear financial picture. Setting up the budget properly from the start is essential, and this is where a process of variance analysis comes in, taking a closer look at where the budget v.s. actual aren't lining up, and digging into the reasons behind that.

KPI: Occupancy Rates

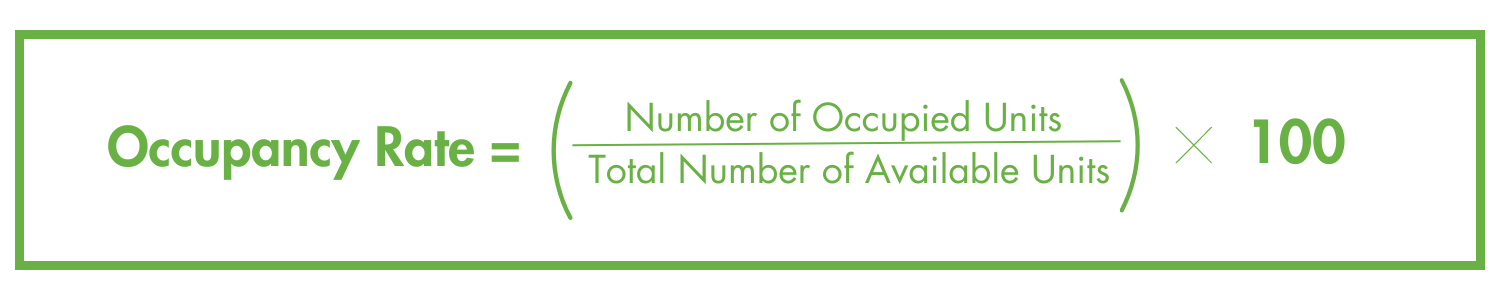

Occupancy rates are a Key Performance Indicator (KPI) in the property management and development industry.

This metric measures the percentage of available units that are occupied and is essential for assessing the financial health and viability of a property. Of course the goal in this industry is that the occupancy rates be as high as possible, combined with a low rate of tenant turnover, and a small window of vacancy.

When advising clients, it's important to understand that occupancy rates vary significantly based on the type of property. Multi-family properties typically experience very low vacancy rates due to high demand for residential units. In contrast, commercial and office real estate has faced a significant downturn in occupancy rates, largely due to the COVID-19 pandemic and the shift towards remote work.

This has resulted in an interesting trend in this industry. Many developers are now focusing on building multifunctional, multi-use properties. For instance, a new development might be designed to initially serve as a school but can be converted into a senior living facility in the future. This flexibility helps mitigate the risks associated with fluctuating occupancy rates and maximizes the long-term utility and profitability of the property.

Balance Sheet Red Flags: Accounts Receivable and Accounts Payable

Two important metrics that can constitute red flags on a balance sheet are Accounts Receivable (A/R) and Accounts Payable (A/P).

-

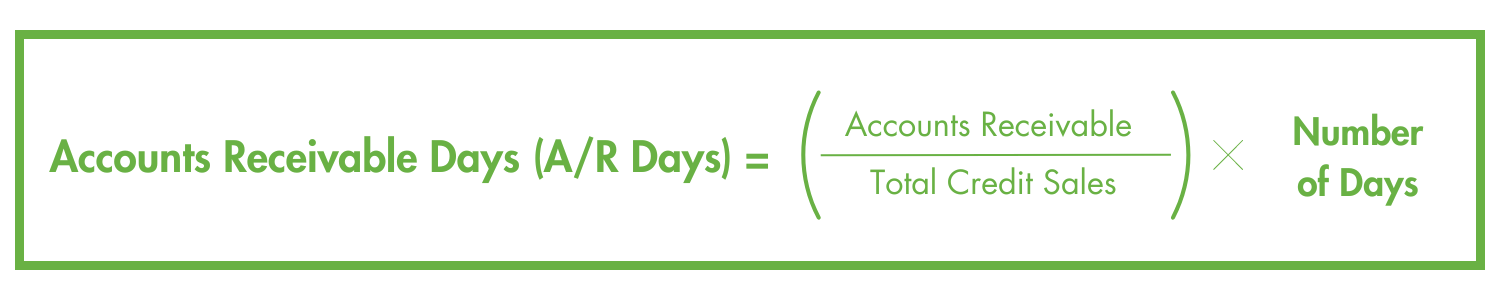

Accounts Receivable:

Ideally, A/R days should remain as low as possible, definitely less than 30 days. In the property management industry, delayed receivables can quickly lead to tenants being unable to pay, impacting overall cash flow. Staying on top of collections is crucial to maintain financial stability.

-

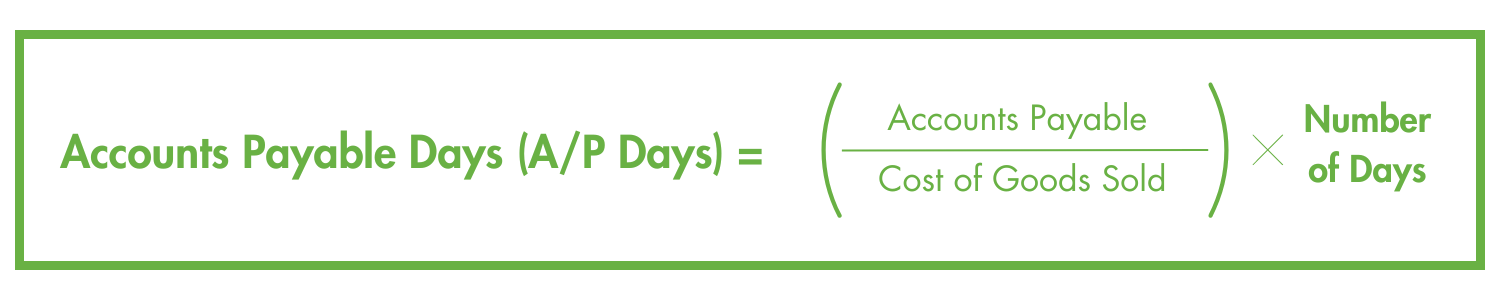

Accounts Payable:

Low A/P numbers indicate healthy cash flow and the client's ability to pay their bills on time. If bills remain unpaid for 60-90 days, it becomes a liability and signals potential cash flow problems. This should be promptly addressed with the client to avoid long-term financial issues.

Just like real estate itself, implementing changes in property management and development is a long-term investment. Since this industry is a slower ship to turn, adjustments and improvements take time to yield results. Equity partners, beyond traditional lenders, can play a crucial role in this process. They can provide the necessary capital to weather financial fluctuations and offer valuable insights for making informed decisions.

The key to effectively managing equity partners is proactive engagement. Don’t wait until challenges arise to seek their input or make changes. By staying ahead of potential issues and maintaining open lines of communication, you can leverage their expertise to drive better outcomes. Proactively managing these relationships and addressing concerns before they escalate will position you and your clients for long-term success in the property management and development sector.