Profitability is one of the key metrics business owners care about, but as a CPA, you know it’s more than just a simple calculation. At its core, profitability measures the difference between total revenue and total expenses, but this metric can be influenced by a range of factors, including accounting methods, management priorities, and industry standards. This blog will walk you through what profitability means, how to identify potential issues, financial formulas you can use, and why profitability is crucial—not just for your clients, but for your own advisory business. Plus, we'll offer some practical steps in the form of a workflow to help improve this metric.

What Is Profitability?

Profitability reflects how much of a company’s revenue is left after covering all expenses. While that might seem straightforward, it's more nuanced than just looking at the profit line. Profit can be manipulated based on accounting methods or timing, so it’s essential to dig deeper into common-sized, comparative ratios that offer more context and insight into how effectively a company is operating.

Financial Formulas for Profitability

As a CPA, you’ll want to leverage several financial formulas to get a well-rounded view of profitability. Here are the key profitability metrics to focus on:

-

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA):

EBITDA evaluates a company’s financial performance by isolating earnings from its core operations. It’s especially useful for comparing companies in the same industry, even if they have different capital structures or tax rates.

-

Return on Assets (ROA):

ROA measures how efficiently a company generates profits from its resources (total assets). Since it varies significantly across industries, ROA is most useful when comparing companies within the same sector.

-

Return on Capital Employed (ROCE):

ROCE gauges how well a company uses its long-term capital. It’s an important measure for evaluating the efficiency and profitability of a company’s investments. ROCE is typically considered good when it’s higher than the rate at which the company borrows.

-

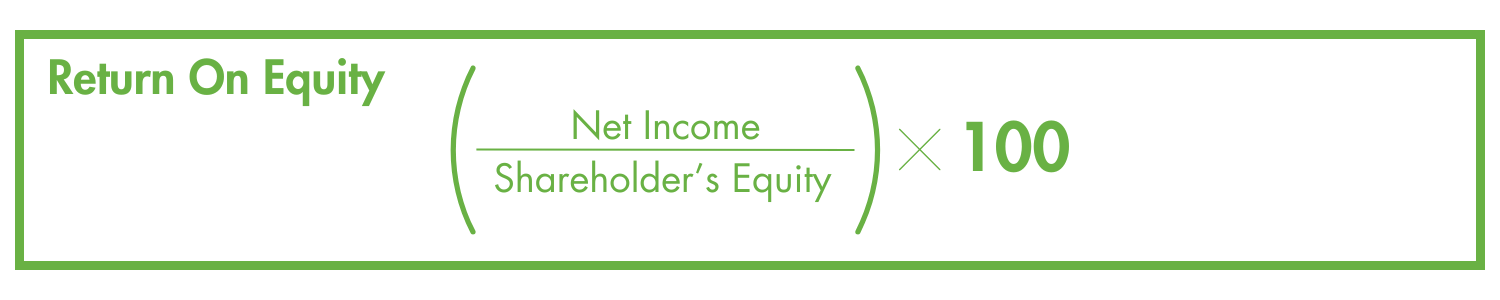

Return on Equity (ROE):

ROE assesses how effectively a company is using its equity to generate profits. The higher, the better—unless the company is heavily leveraged. A U.S. company with an ROE of 10-12% is generally considered performing well.

How to Spot an Issue in Profitability

Profitability issues often manifest in declining margins, stagnating ROA, or a widening gap between revenue and net income. Look for the following red flags in your clients' financials:

- Lower-than-average EBITDA for the industry, which might suggest operational inefficiencies.

- Decreasing ROA over time, pointing to poor use of assets.

- ROCE falling below borrowing rates, signaling that capital investments aren’t paying off.

- ROE dropping despite growing revenue, potentially indicating that leverage is becoming an issue.

Once you spot these issues, it’s time to act.

Why Profitability Is So Important

Profitability isn’t just about how much money a company makes—it's a key indicator of financial health. It tells you whether a business is effectively managing its costs, whether its capital investments are worthwhile, and how efficiently it’s using its resources. For your clients, improving profitability can mean more financial stability, better cash flow, and the ability to reinvest in their business. For you, as a CPA offering advisory services, helping clients improve profitability directly ties into higher advisory fees and long-term client relationships.

Practical Workflow to Improve Profitability

Now that you understand the importance of profitability and how to identify issues, here’s a step-by-step workflow to help your clients improve this metric:

1. Analyze Financials:

- Begin by reviewing the company’s financial statements and identifying which profitability ratios (EBITDA, ROA, ROCE, or ROE) need improvement.

2. Benchmark Against Competitors:

- Use industry benchmarks to compare your client’s performance. This will give you a clearer picture of where they stand relative to others in their space.

3. Identify Cost Drivers:

- Pinpoint the largest contributors to expenses. Are there inefficiencies in operations, too much debt, or underperforming assets?

4. Develop a Plan:

- Work with your client to create a roadmap for reducing unnecessary costs, improving asset utilization, and optimizing capital investments.

5. Monitor and Adjust:

- Continuously track profitability metrics over time, making adjustments as needed. Profitability improvement is not a one-and-done deal; it requires ongoing attention.

6. Communicate Wins:

- Highlight areas of improvement in profitability to your clients, showing them the direct benefits of your advisory work.

Why Improving Profitability Benefits Both You and Your Clients

When you help clients improve their profitability, you’re not just boosting their bottom line; you’re providing them with actionable insights that lead to sustainable growth. This opens the door for more advisory opportunities for you—whether it's strategic planning, forecasting, or deeper analysis of other performance metrics. The more value you offer, the more likely clients will come back to you for ongoing services, translating into increased revenue for your firm.

Top 3 Industries Where Profitability Metrics Matter Most

-

Manufacturing:

Small changes in operational efficiency can have significant impacts on margins, making profitability metrics like ROA and ROCE crucial.

-

Healthcare:

Profitability often comes down to controlling costs while maintaining quality care, making it important to measure EBITDA and ROE to assess long-term sustainability.

-

Technology:

Fast-growing tech companies must manage profitability carefully to balance growth with sustainable operations, making all profitability metrics relevant to track.

By focusing on profitability metrics and offering practical, actionable advice to your clients, you’ll be better positioned to deliver more value, deepen relationships, and grow your advisory practice.