The following post is a summarization of insights based on conversations from the Best Metrics Podcast featuring industry leaders Wade Maleck and Patrick Smith, of CLA. Listen here to the full episode.

Navigating the Technology and SaaS industry requires a deep understanding of key metrics that drive business success. Whether advising a startup or an established company, the relevance of various metrics is crucial in shaping strategic decisions. In a recent episode of the Best Metrics Podcast, we explored essential metrics and best practices for companies in this industry with leaders Wade Maleck and Patrick Smith of CLA.

Typically the Technology and SaaS industry is divided into two main categories: companies just starting out and established companies refining their operations. The relevance of various metrics depends on which category the company you’re advising falls into.

Once things are up and running, you're aiming for a 75%-85% profit margin ideally. Again, if a company isn't in this range, they might be in an early stage, but this industry standard is a good benchmark for setting KPIs.

For a company in this industry, there typically isn't much that goes into the COGS beyond customer success. This is the largest portion and is heavily weighted in the Tech and SaaS industry. However, within customer success are different metrics that should ideally be broken down into 4 different "buckets" or categories:

- Sales

- Marketing

- General and Administrative Costs (G&A)

- Research and Development Costs (R&D)

Breaking things down in this way is important to do from the beginning, enabling you to measure progress over time, and set you up for success when making presentations to potential investors that are looking at your financials.

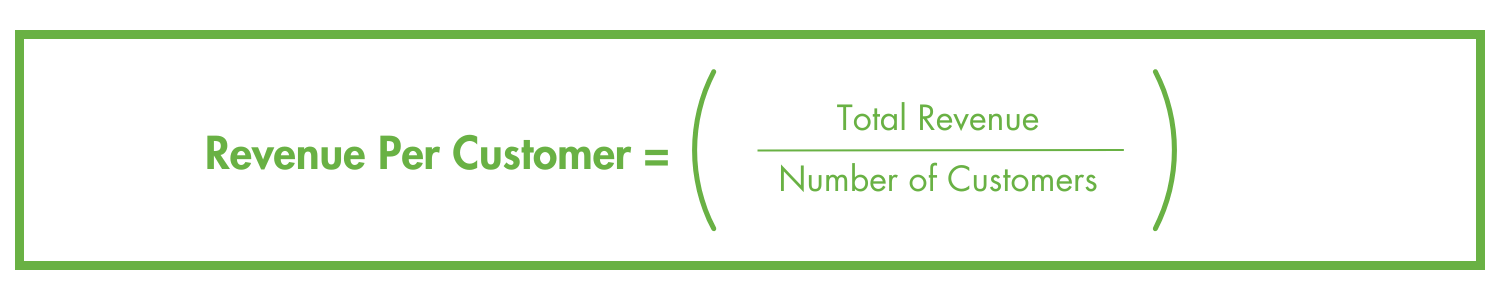

Average Revenue Per Customer

Pricing for a SaaS firm is always tricky. Low price & high volume could be the strategy. High price & low volume is another option. What you're trying to determine with this metric is whether the firm is not only covering costs but also generating a profit with each new sale. This metric is also significant when viewed in the context of other metrics, especially Customer Churn Rate.

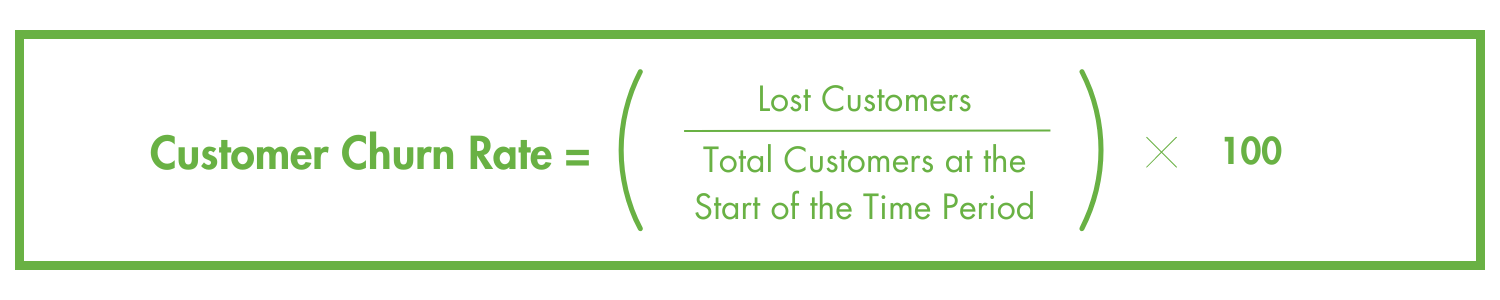

Customer Churn Rate

The churn rate indicates how many customers you are losing regularly. This can be measured monthly, quarterly, or yearly, depending on the size of the business.

When the Average Revenue Per Customer and the Customer Churn Rate are analyzed together, they result in the Lifetime Revenue Per Customer.

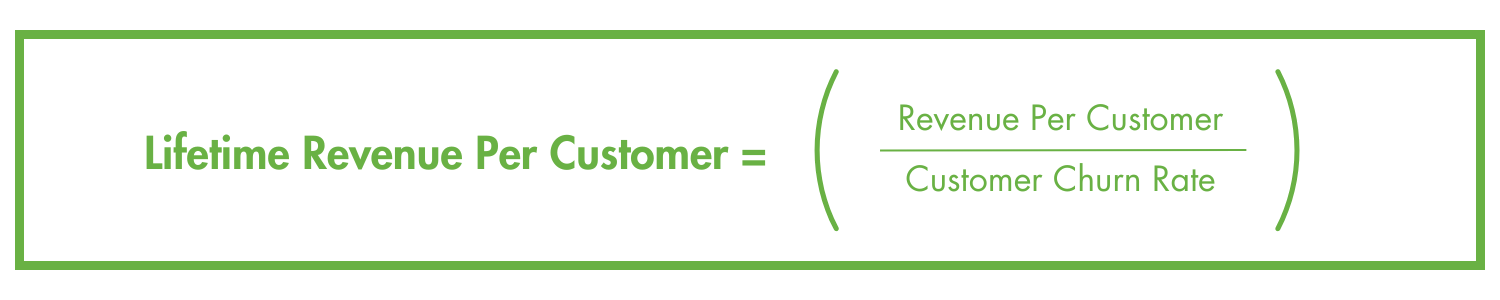

Lifetime Revenue Per Customer

Knowing the Lifetime Revenue Per Customer helps us understand how much we can expect to earn from each customer, informing us how much we can spend to acquire that customer. A 4:1 ratio for the Lifetime Revenue Per Customer to cost of Customer Aquisition is ideal.

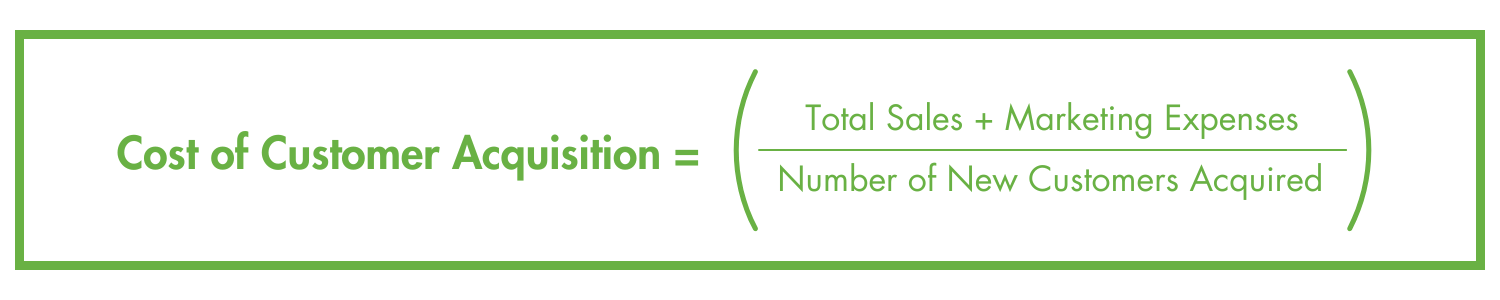

Cost of Customer Acquisition

Ideally, the goal for a paying pay the customer acquisition cost in this industry is 18 months. These numbers are key for determining the average cost of services, setting appropriate pricing, and adjusting services as needed.

Net Negative Churn

This metric includes three important numbers:

- Customer Churn Rate: The number of customers lost over a period of time.

- Contraction Rate: The rate at which existing customers reduce their spending, decreasing recurring revenue.

- Expansion Rate: The rate at which existing customers increase their usage of your product or service, such as adding seats or purchasing new products.

By keeping these metrics in mind, you can better navigate the challenges and opportunities in the Technology and SaaS industry, driving your company's growth and success.

ARR and MRR

For SaaS companies, two critical metrics to monitor are Monthly Recurring Revenue (MRR) from software subscriptions and Annual Recurring Revenue (ARR) from subscriptions from a calendar year. Unlike traditional companies, SaaS businesses typically do not deal with Accounts Receivable (A/R) Days. Therefore, MRR and ARR are essential for tracking a company's growth over time.

Deferred Revenue

Deferred Revenue is particularly significant for enterprise companies or those offering an enterprise level solution. It is best practice to report deferred revenue as a footnote in financial statements, categorizing it under bookings and signed deals that are deferred until lead time and implementation are completed. This metric serves as an indicator, and while precision is important, it's crucial not to get overly focused on minute details.

The Rule of 40

The Rule of 40 stands as a critical benchmark for assessing whether a business is using its capital efficiently to fuel growth. This rule combines a company's revenue growth rate with its EBITDA percentage to determine its overall efficiency. For instance, if a company is experiencing a 60% year-over-year revenue growth but has a -20% EBITDA, the combined score would be 40%, indicating efficient use of capital despite operating at a loss. This benchmark reassures investors and stakeholders that the company is growing at a sufficient pace relative to its expenditures. Conversely, if the combined score falls below 40%, it may signal the need for reassessment of spending and strategy to ensure sustainable growth. The Rule of 40 can also guide companies to balance growth with profitability, suggesting that if revenue growth is only 30%, achieving a 10% EBITDA margin would still meet the efficiency criteria. Thus, the Rule of 40 serves as a vital tool for making informed strategic decisions in the dynamic tech and SaaS sectors.

Average Cost of Service

In the Tech and SaaS industries, the Average Cost of Service (ACS) is a crucial metric that helps companies understand the efficiency and profitability of their service delivery. ACS measures the average expense incurred to deliver a service to each customer, enabling businesses to identify cost-saving opportunities and optimize their operations. By keeping ACS low while maintaining high service quality, companies can enhance their profit margins and offer competitive pricing.

Common Mistakes

“An ounce of prevention is worth a pound of cure.”

A critical pitfall that CPAs and tech company owners must avoid is failing to file an 83(b) election in a timely manner when issuing restricted stock or equity compensation. Missing this election, which must be made within 30 days of the stock grant, can lead to severe tax consequences. Without the 83(b) election, the recipient of the stock could face substantial income tax liabilities when the stock vests and its value has significantly increased, often without the cash to pay the taxes. Conversely, making the election at the time of the grant allows the stock to be taxed at its initial, typically lower value, and any future appreciation is taxed as capital gains rather than ordinary income. This foresight is crucial, as rectifying a missed 83(b) election is complex and can leave the company and its founders in a challenging financial position, emphasizing the importance of timely and accurate tax filings.

By focusing on these critical metrics, companies in the Technology and SaaS industry can better navigate challenges and capitalize on opportunities, driving sustained growth and success. Understanding and leveraging these metrics will enable businesses to optimize their operations, improve financial performance, and enhance customer relationships.

Comments shared as general information but are not intended to serve as tax advice. Please consult with your CPA to get specific tax advice appropriate to you, your location, and your situation.

Listen Here to the entire episode and for additional insights into this dynamic industry.

Peerview Data is your partner in uncovering these crucial insights. Our advanced data analytics tools help you find the answers to these questions, crunch the data, and determine actionable benchmarks. With Peerview Data, you gain the clarity and precision needed to transform your metrics into strategic growth drivers. Let us help you elevate your practice and achieve your business goals.