Think of tracking your business growth like watching a tree grow. At first, you plant the seed, water it, and hope for the best. Over time, you measure its height, check its health, and look for signs of growth. When the tree thrives, it’s rewarding to see your hard work pay off. However, if it doesn’t, you know something needs to change — maybe more sunlight or water. Similarly, in business, tracking Customer Growth Rate (CGR) lets you understand how your customer base is growing and if your strategies are working as intended.

What is Customer Growth Rate?

Customer Growth Rate (CGR) is a key performance indicator (KPI) that measures how much your customer base has increased over a set period. It’s a simple yet powerful metric that shows how effectively your business is attracting and retaining customers.

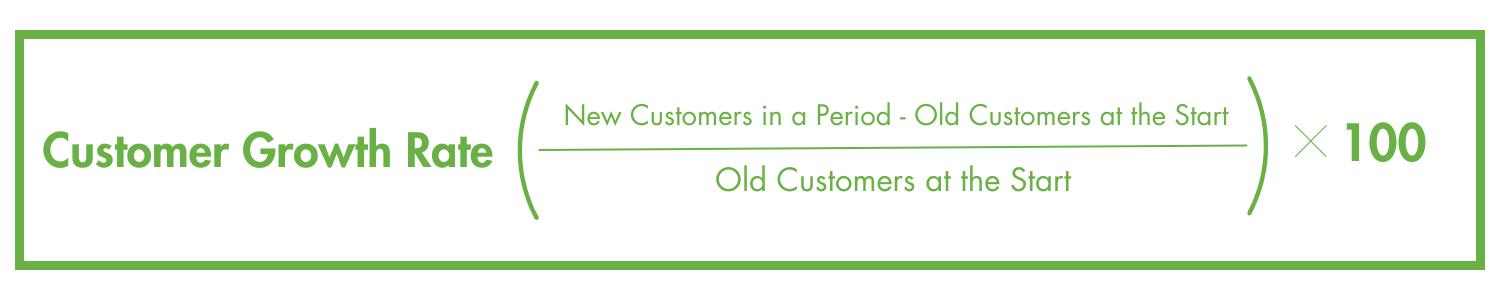

The Formula for Customer Growth Rate:

The formula to calculate CGR is:

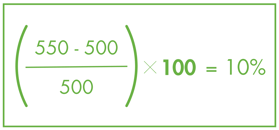

For example, if a business starts the quarter with 500 customers and gains 50 new ones, the CGR would be:

This means the company experienced a 10% growth in its customer base during the quarter.

Why is Customer Growth Rate Important?

CGR is important because it tells you whether your business is expanding or stalling. If you see a steady increase, it’s a sign that your services are in demand and that your marketing and client retention strategies are working. On the flip side, a slow or declining growth rate signals that something may be off — perhaps your offerings aren’t resonating with the market, or there’s an issue with customer retention.

By paying attention to this metric, CPAs can help their clients identify trends, optimize strategies, and prevent revenue loss from shrinking customer bases. Moreover, advising on CGR also opens doors to more billable opportunities by providing clients with data-driven insights.

How to Identify Issues with Customer Growth Rate

If your client’s CGR is flat or declining, it’s a red flag that something’s not working. Here's what to watch for:

- A sudden drop: Was there a specific event that triggered the loss of customers? Perhaps a pricing change, service disruption, or negative press?

- Plateaued growth: If the customer base isn’t expanding, it could indicate that the company has reached market saturation or that the product/service needs to evolve.

- High churn rate: A slow CGR combined with high churn means that while new customers are coming in, they aren’t staying long enough to generate significant revenue.

Steps to Improve Customer Growth Rate

Improving CGR requires a strategic approach. Here’s a workflow you can use with your clients:

-

Analyze Current Growth Trends

Review your client’s historical CGR data to identify spikes and dips. Did they change their pricing, launch a new marketing campaign, or add a product when growth spiked? If so, lean into these strategies. If there was a lull, evaluate what could’ve gone wrong and explore alternatives.

-

Optimize Customer Acquisition Strategies

Ensure your clients are focusing on lead generation. Evaluate current marketing channels (e.g., social media, email campaigns, referrals) and assess which ones bring in the most customers. Double down on the most effective channels.

-

Enhance Customer Retention

High retention equals higher growth. Encourage your clients to strengthen customer relationships through improved support, loyalty programs, or regular feedback loops. Retained customers also tend to refer new clients, leading to organic growth.

-

Test and Innovate

Work with your clients to try new approaches — perhaps offering a discount for referrals, launching a new product, or expanding into a different market. Be agile and adjust based on feedback and results.

-

Monitor and Adjust

Continuous monitoring is key. Keep an eye on CGR and adjust strategies accordingly. This isn’t a "set it and forget it" KPI — success comes from staying responsive to the data.

Top Industries Where Customer Growth Rate is Most Relevant

While CGR is important across all industries, it’s especially crucial in these three sectors:

-

SaaS (Software as a Service):

Recurring revenue depends on both acquiring new customers and retaining them. High CGR here means better scalability and future revenue projections.

-

Retail:

Retailers must attract and retain customers consistently. A high CGR means growing brand loyalty and expanding market share, which translates directly to sales growth.

-

E-Commerce:

In this highly competitive space, CGR helps businesses understand how effectively they are converting website visitors into long-term customers.

How CGR Benefits You and Your Clients

For your clients, improving CGR leads to more predictable revenue, stronger customer loyalty, and a better competitive edge. For you as a CPA, helping your clients increase their customer base offers a direct opportunity for more advisory work. Each conversation about CGR can lead to discussions on strategic planning, marketing optimization, and pricing strategies — all of which can help grow your practice, too.

By taking a proactive approach to CGR, you’re not just helping clients boost their bottom line, you’re also strengthening your advisory services and your value to them.