How to Use Net Income Growth Rate to Boost Your Firm and Help Your Clients

When it comes to measuring a business's financial health, Net Income Growth Rate is one of the most revealing metrics. It tells the story of how efficiently a company is turning its operations into profit over time. As a CPA, understanding this metric helps you identify areas where a company is thriving — or struggling — so you can guide your clients toward making smarter financial decisions.

What is Net Income Growth Rate?

Net Income Growth Rate measures the percentage increase or decrease in a company’s net income from one period to the next, usually compared over years, quarters, or months. Essentially, it shows how much a company’s profitability has improved or declined over time.

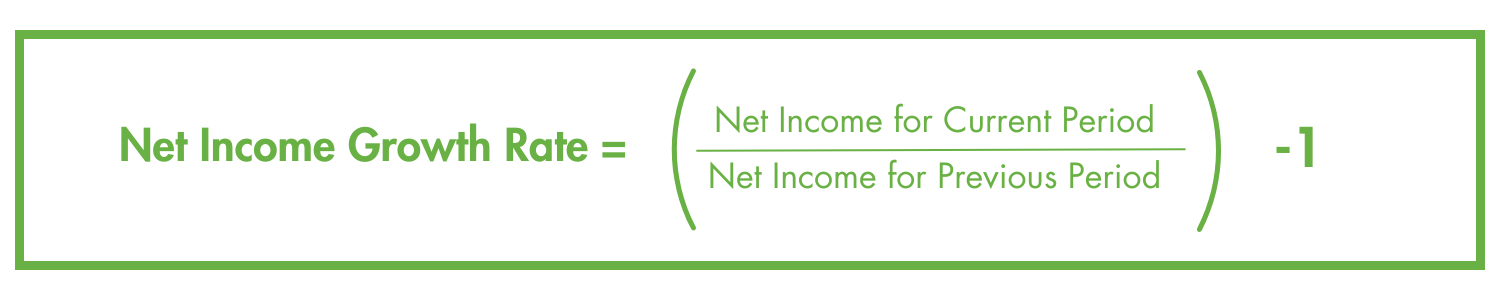

The Formula for Net Income Growth Rate

The formula to calculate Net Income Growth Rate is straightforward:

For example, if a company’s net income was $100,000 last year and it’s $120,000 this year, the Net Income Growth Rate would be:

.png?width=378&height=176&name=Financial%20formulas3%20(1).png)

This means the company's net income grew by 20% compared to the previous year.

Why Net Income Growth Rate is Important

Net Income Growth Rate is a powerful indicator of a company's operational efficiency and profitability. If net income is consistently growing, it’s a sign that the business is generating more profit, controlling costs, and operating efficiently. This metric is also important from an investment standpoint — investors often look at net income growth to gauge the company’s financial health and potential for future growth.

However, this metric should not be analyzed in isolation. It's heavily influenced by the company’s objectives, industry life cycle (whether it’s in a growth, maturity, or decline stage), and other metrics like revenue growth, margins, and cash flow. For example, a business in a high-growth phase might not see much net income growth initially because of reinvestment into expansion efforts, but that doesn’t necessarily mean the business is underperforming.

How to Identify Issues with Net Income Growth Rate

As a CPA, you'll want to look out for the following when assessing Net Income Growth Rate:

- No or Low Net Income Growth: This could signal issues like rising costs, declining demand, or inefficiencies in operations. However, it’s essential to look at this in conjunction with revenue growth, the company’s stage in its industry life cycle, and the strength of the product or service fit in the market.

- High Net Income Growth: While high growth is generally a good sign, it’s important to assess whether it’s sustainable. Is the company allocating resources wisely? Is this growth coming at the expense of long-term reinvestment, or is it aligned with revenue and market expansion?

Practical Steps to Improve Net Income Growth Rate

If you find that a client’s Net Income Growth Rate is stagnating or declining, there are several strategic steps you can guide them through. Here’s a simple workflow to help improve this metric:

-

Assess Cost Structure

- Begin by analyzing the company's cost structure. Are there any areas where costs are disproportionately high compared to revenue? Identify opportunities to reduce expenses without compromising product or service quality.

-

Increase Revenue Streams

- Explore additional ways your client can grow revenue, whether through expanding product lines, entering new markets, or adjusting pricing strategies. Improved revenue generally leads to better net income growth, especially if costs remain steady.

-

Review Pricing Strategy

- Encourage your clients to reevaluate their pricing. Are they charging enough for their products or services? Small price adjustments can lead to significant improvements in profitability without needing to drastically change operations.

-

Monitor and Optimize Margins

- Keep an eye on gross and operating margins. If margins are shrinking while net income growth is low, it could indicate inefficiencies in production or service delivery. Help your clients streamline processes to improve their margins.

-

Evaluate Resource Allocation

- Is your client reinvesting profits wisely? Make sure they aren’t overextending themselves in areas that don’t align with their growth strategy. Reinvesting in technology, staff training, or product development can lead to better long-term profitability.

-

Track Financial Ratios Regularly

- Net income growth doesn’t exist in a vacuum. It’s essential to also track related metrics like revenue growth, EBITDA, cash flow, and liquidity. An overall financial health check will help you better advise your clients on sustainable growth.

Top Industries Where Net Income Growth Rate is Most Relevant

While Net Income Growth Rate is useful across all sectors, it’s particularly important in the following industries:

-

Manufacturing:

Efficiency and cost control are critical in manufacturing. A high Net Income Growth Rate signals that a company is managing its operations and costs effectively.

-

Retail:

Retail businesses operate on thin margins, so profitability is key. An improving Net Income Growth Rate often reflects better inventory management, cost-cutting, or successful pricing strategies.

-

Technology (SaaS):

Many tech companies focus on revenue growth in their early stages, but once they mature, Net Income Growth Rate becomes crucial. A high rate indicates that the company is scaling profitably and not just burning through cash for growth.

How Improving Net Income Growth Rate Benefits You and Your Clients

Helping your clients improve their Net Income Growth Rate doesn’t just help their bottom line — it benefits your practice as well. When you guide clients toward more profitable operations, they’ll value your strategic input, leading to stronger client relationships and more billable advisory opportunities. Improved net income also means your clients have more resources to reinvest in your services, allowing you to grow your own practice alongside them.

In the end, focusing on Net Income Growth Rate isn’t just about hitting the numbers. It’s about ensuring long-term financial health for your clients, guiding them through market challenges, and helping them navigate the complexities of growth. This not only makes you a more valuable advisor but also positions you as a key part of their long-term success strategy.