Are you a bank? Or a credit card company?

For too many small businesses, the answer is a lot closer to “yes” than “no.” Why? Accounts Receivable — the longer you finance your clients or customers, the worse it is for your business. This quote neatly sums up the problem:

“…profitability and cash flow are two very different things. I was, and remain, amazed at how many profitable companies are strangled by negative cash flow.”

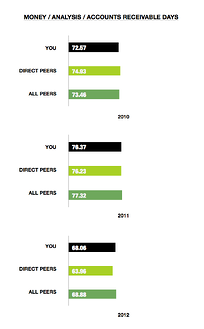

What’s “normal” for Accounts Receivable?

Different industries have different standards; one reason we collect and report Accounts Receviable data from our subscribers is to give them an idea of what they should expect and whether or not they’re being paid faster or slower than their peers. If they’re being paid slower, they can implement new Accounts Receivable procedures or offer incentives to speed up the process.

From Entrepreneur.