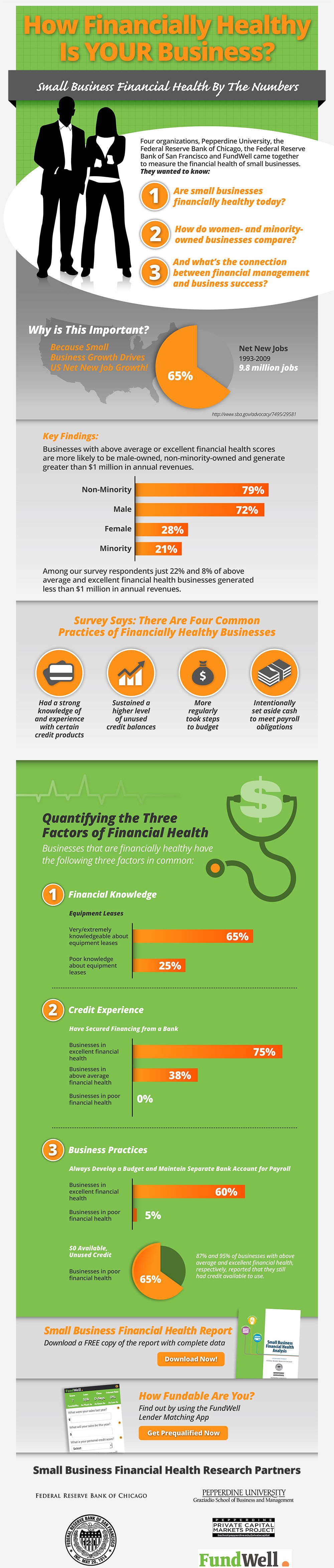

Most companies know they need to benchmark their performance if they want to stay competitive but they don’t have the means to do it themselves.

Even those with dedicated CFOs, COOs, CPOs and CMOs find that the process of aggregating and analyzing all that industry, trend and competitive data is not only time consuming and difficult, but expensive.

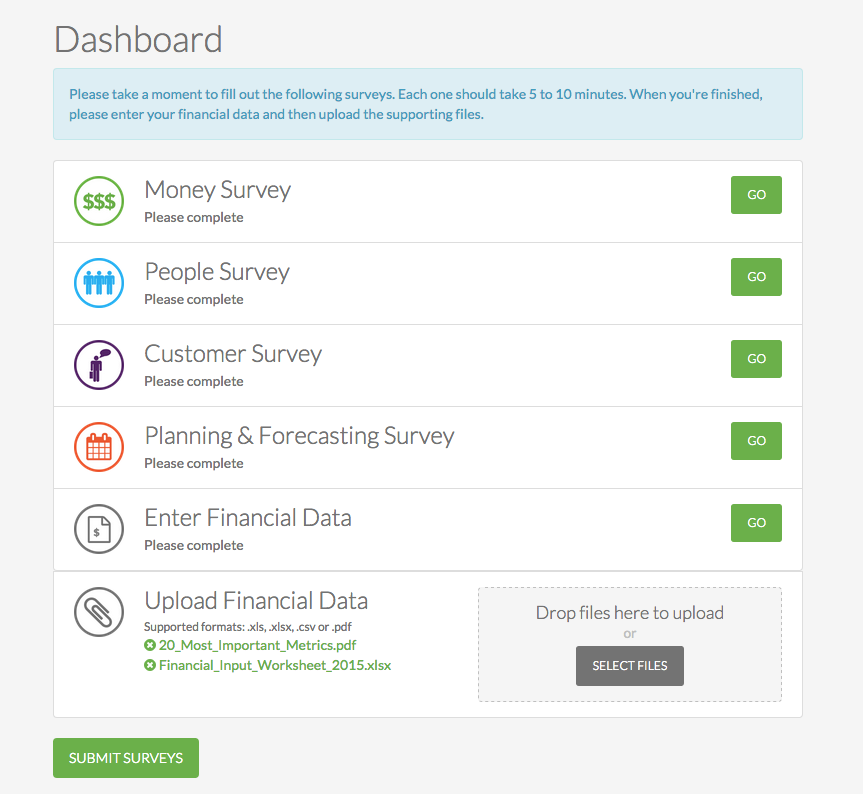

Our online tool does it for them.