We spend a lot of time working with accounting firms, talking to accounting firms, thinking about accounting firms and showing accounting firms how they can use our "Do It For Me" Big Data, analytics and benchmarking solution to give themselves and their clients better insights.

The other day, somebody said "What would you do if you ran an accounting firm?"

After imagining my own personal accountant laughing hysterically at the idea, I stopped for a minute to think.

As an outsider looking in,

I would do three simple things:

- Leverage my client data. (Not sell it, but use it to help my clients, and by extension, help myself.)

- Look for ways to interact with my clients so I could prove value.

- Expand beyond tax and audit to offer more proactive consultative services so I could add value.

Here's why.

The value proposition for the typical accounting firm has changed. What used to be "

task X for payment Y" is now almost the opposite to

"payment Y for task X."

The problem with putting price first is that's the hardest thing to compete on, especially when technology solutions deliver sufficient quality to satisfy clients

— i

f price and quality are equal, price wins.

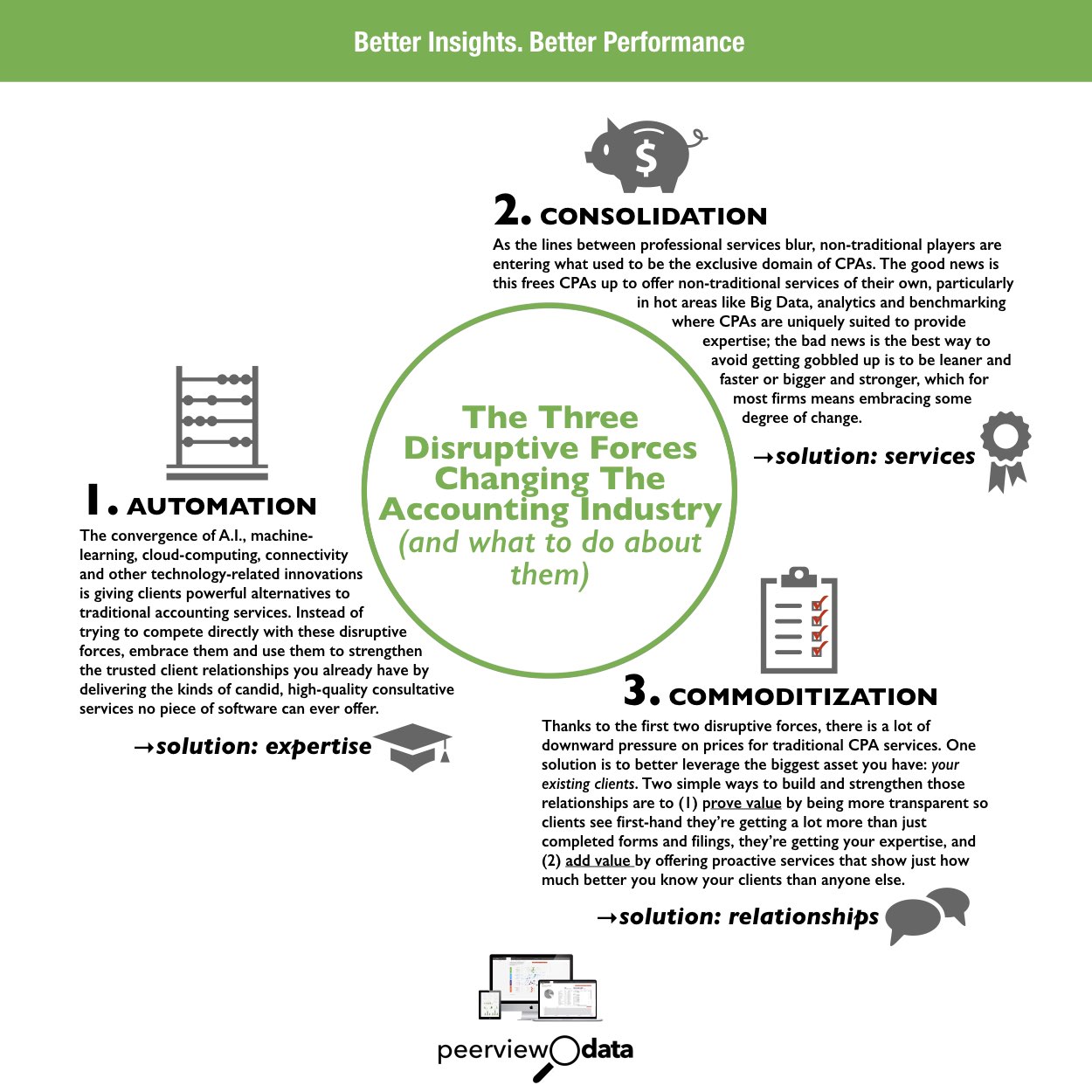

Faced with current and emerging technology that can accomplish traditional accounting tasks faster, cheaper and in some cases better, CPA firms are going to have to adapt if they want to survive.

(Greg Satell talks more this kind of disruption

in "

This is How Your Business Will Be Disrupted

," but the upshot is that even successful companies eventually become square-peg businesses in round-hole industries,

"not because they somehow become stupid and lazy all of a sudden,"

he says,

"but because the world changes and they lose relevance. Then those same practices that led to success now lead to failure."

)

As challenging as any kind of change can be from an institutional standpoint, forward-thinking firms always embrace the inevitable and try to get the jump on competitors.

Given that,

the first thing I'd do is

take the client financial data I'm already collecting and analyze it so I could identify my client's strengths and weaknesses. Then I'd sit down with them and explain what I'd found, why it matters and how I could further help them.

Even if they didn't engage me to show them how to

leverage their strengths, strengthen their weaknesses, fix pain their points or do a deeper dive in some specific performance area, just being proactive in providing an assessment would prove value, which would boost satisfaction and retention.

If they did engage me afterwards, that would

add value.