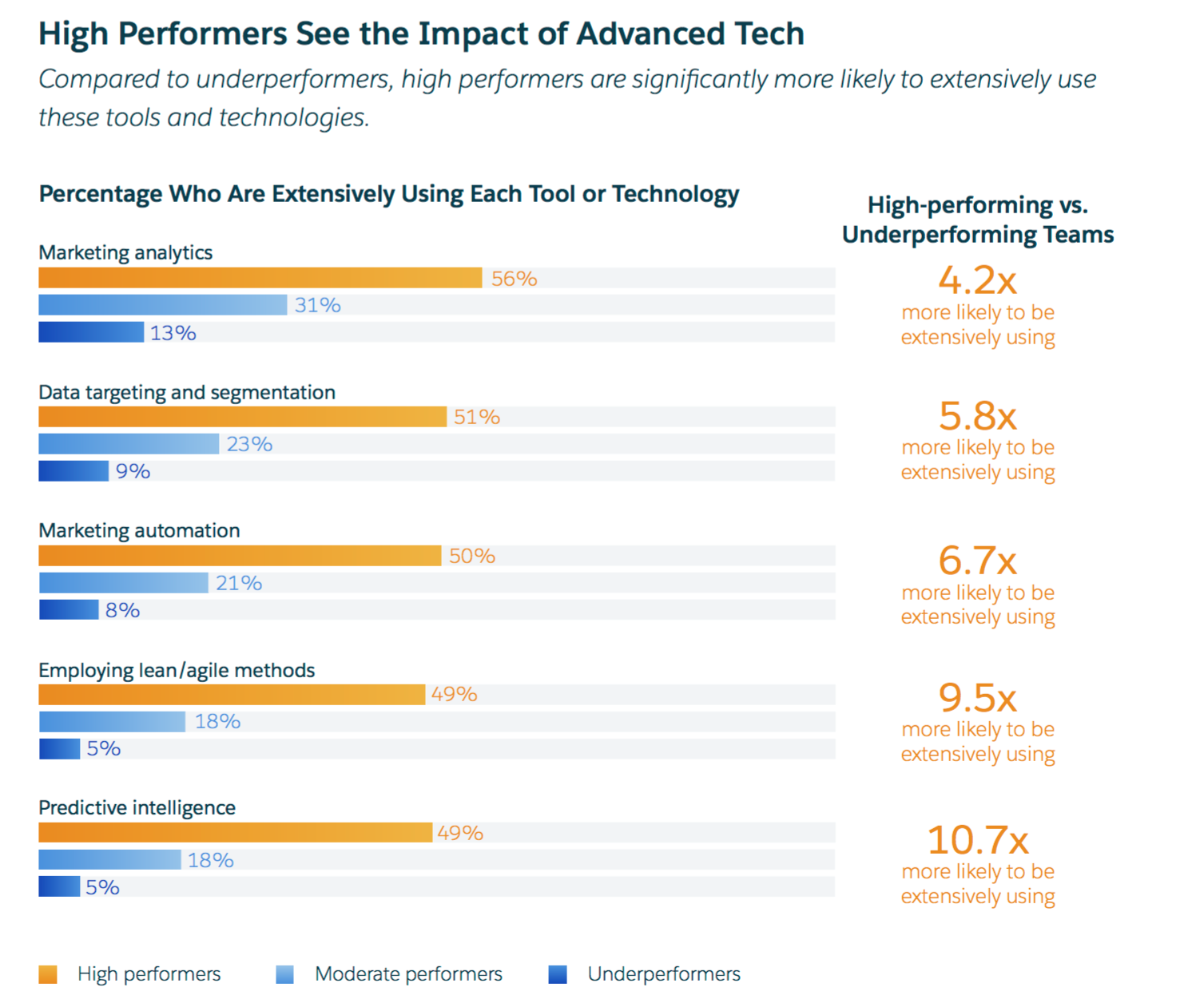

What separates good marketers from bad marketers?

According to Salesforce’s 2016 State of Marketing report, "extensively using" these five data-driven tools and technologies are at the heart of their success:

- marketing analytics (aggregating and benchmarking internal and external performance data to help determine your marketing who, what, when, why and how)

- customer targeting and segmentation (using internal and external performance data to determine who gets what, when, why and how)

- marketing automation (using internal and external performance data to program what, when and how)

- agile marketing (test → measure → revise → repeat, with benchmarks differentiating "winners" from "losers")

- predictive intelligence (using internal and external performance data to estimate future actions or outcomes)

How many do you use?

_____________________________

Don't let your data go to waste.

See how our Strategic Analysis & Benchmarking tool can help you tap the information you already collect to become more competitive.

→ Request a 15-minute, no-pressure demo:

_____________________________