One of the main reasons companies use our strategic analysis & benchmarking tool is to get better insights out of the data they already collect so they can address pain points — high turnover, cash flow issues, an un-engaging brand, etc.

What's interesting is that in a lot of cases the root cause of the problem isn't what they thought it would be or where they thought it would be.

How is that possible?

Even though we assign roles and responsibilities by department or functional area, nothing in business is completely isolated. Everything is linked and interconnected in such a way that all these individual actions form a giant kinematic chain in which the "movement" of one affects the "movement" of another, sometimes something that's much further down the line.

This is why a marketing problem isn't always a marketing problem, but can be a company culture problem instead.

Or a sales problem can be a finance problem.

(The same thing is true for people, which is why knee pain is often traced back to foot problems and limited hip mobility can make your back hurt.)

How do you know when that's the case?

You don't.

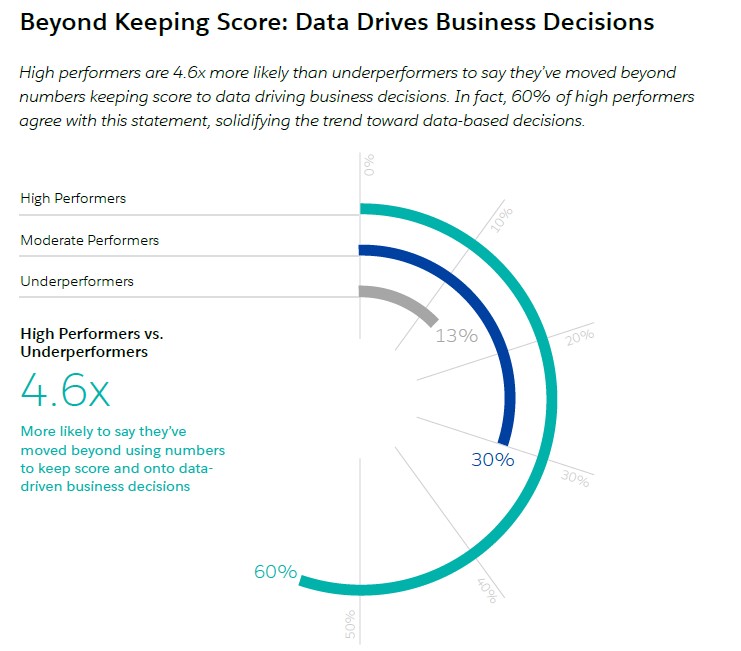

That's why it's important to analyze your performance data.

Here's an example:

One of our clients came to us because they were having turnover issues. Because we provide both "scoreboard" metrics and "differential" metrics, they were able to rule out the obvious causes: uncompetitive salaries and benefits, limited opportunities for advancement, unrealistic productivity demand, bad management, etc.

What they eventually realized was they actually had a "grass is greener" problem — their employees were leaving because they didn't realize how well the company was treating them and how strongly it was performing — which they solved by sharing their Peerview Data analysis so everyone internally could see just how green the grass really was.

The result?

Over the next two years, they cut their turnover rate in half.